All Categories

Featured

Table of Contents

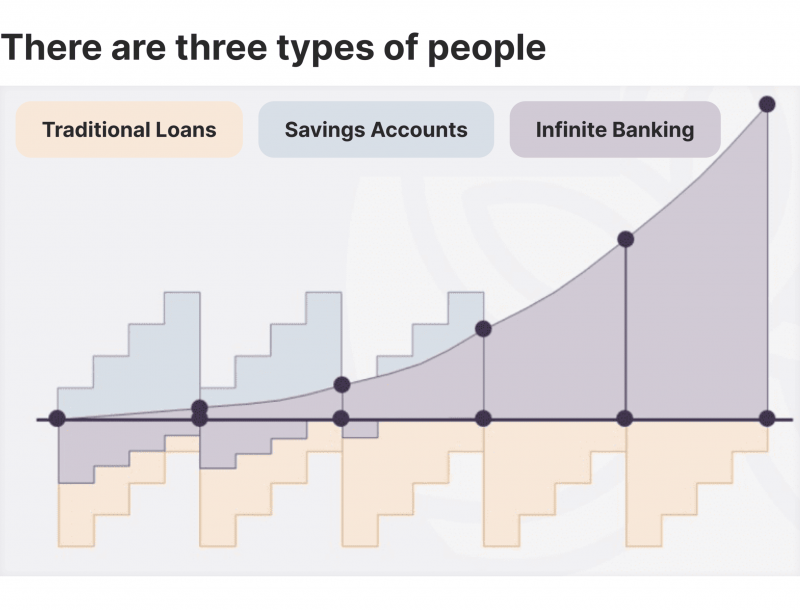

For a lot of people, the biggest trouble with the boundless banking principle is that preliminary hit to very early liquidity triggered by the prices. Although this disadvantage of limitless financial can be decreased significantly with correct plan design, the initial years will certainly always be the most awful years with any kind of Whole Life plan.

That stated, there are particular unlimited financial life insurance coverage plans designed mostly for high very early money worth (HECV) of over 90% in the first year. The lasting efficiency will frequently significantly delay the best-performing Infinite Banking life insurance policy policies. Having access to that additional 4 numbers in the initial couple of years might come at the cost of 6-figures down the road.

You really get some substantial long-term benefits that aid you redeem these early prices and after that some. We find that this prevented early liquidity problem with unlimited banking is a lot more psychological than anything else when extensively discovered. If they definitely required every penny of the cash missing out on from their unlimited banking life insurance plan in the first few years.

Tag: boundless banking concept In this episode, I talk regarding finances with Mary Jo Irmen who instructs the Infinite Banking Idea. With the increase of TikTok as an information-sharing system, monetary advice and techniques have discovered an unique method of dispersing. One such technique that has actually been making the rounds is the boundless financial principle, or IBC for brief, amassing recommendations from stars like rapper Waka Flocka Fire.

Within these plans, the money worth expands based upon a rate set by the insurance provider. As soon as a substantial cash value gathers, insurance holders can obtain a cash money worth lending. These finances vary from conventional ones, with life insurance policy working as security, indicating one can lose their protection if borrowing exceedingly without appropriate cash money worth to support the insurance policy costs.

And while the appeal of these policies appears, there are inherent constraints and threats, demanding persistent cash money worth surveillance. The method's authenticity isn't black and white. For high-net-worth people or business owners, specifically those using techniques like company-owned life insurance (COLI), the benefits of tax obligation breaks and compound development can be appealing.

Infinite Banking Explained

The allure of unlimited banking doesn't negate its obstacles: Price: The foundational requirement, a permanent life insurance plan, is costlier than its term counterparts. Eligibility: Not everybody receives whole life insurance policy as a result of extensive underwriting procedures that can omit those with specific health and wellness or lifestyle problems. Intricacy and danger: The complex nature of IBC, paired with its risks, might hinder lots of, specifically when easier and less dangerous choices are available.

Alloting around 10% of your monthly earnings to the plan is simply not feasible for a lot of individuals. Part of what you review below is simply a reiteration of what has already been stated above.

So prior to you obtain right into a situation you're not gotten ready for, recognize the adhering to first: Although the principle is frequently marketed as such, you're not really taking a finance from on your own. If that held true, you would not need to settle it. Rather, you're obtaining from the insurance provider and need to settle it with interest.

Some social networks messages recommend utilizing cash worth from entire life insurance policy to pay down bank card financial debt. The idea is that when you pay back the lending with rate of interest, the amount will certainly be sent out back to your investments. Sadly, that's not just how it works. When you repay the funding, a portion of that passion goes to the insurance firm.

For the first a number of years, you'll be paying off the payment. This makes it very tough for your plan to gather value during this time. Unless you can manage to pay a couple of to numerous hundred dollars for the following years or more, IBC will not work for you.

My Wallet Be Your Own Bank

If you call for life insurance policy, below are some valuable ideas to take into consideration: Take into consideration term life insurance policy. Make sure to go shopping around for the best rate.

Copyright (c) 2023, Intercom, Inc. () with Reserved Typeface Call "Montserrat". Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Scheduled Font Style Call "Montserrat".

Royal Bank Visa Infinite Avion Rewards

As a CPA concentrating on realty investing, I've combed shoulders with the "Infinite Financial Principle" (IBC) extra times than I can count. I have actually also interviewed specialists on the subject. The main draw, other than the obvious life insurance benefits, was always the concept of accumulating money worth within a permanent life insurance policy plan and loaning versus it.

Certain, that makes feeling. Honestly, I always believed that money would certainly be better invested directly on investments rather than channeling it with a life insurance policy Until I found just how IBC could be incorporated with an Irrevocable Life Insurance Coverage Count On (ILIT) to produce generational riches. Let's start with the fundamentals.

Infinite Banking Course

When you obtain against your policy's money value, there's no set payment timetable, giving you the liberty to take care of the funding on your terms. At the same time, the cash value proceeds to expand based on the policy's warranties and returns. This setup allows you to access liquidity without interrupting the lasting development of your plan, gave that the finance and passion are managed carefully.

The procedure proceeds with future generations. As grandchildren are born and expand up, the ILIT can purchase life insurance plans on their lives as well. The trust fund then gathers several plans, each with growing cash worths and fatality benefits. With these policies in area, the ILIT properly ends up being a "Family members Bank." Relative can take financings from the ILIT, utilizing the cash money value of the plans to fund financial investments, begin companies, or cover major expenditures.

A vital facet of handling this Family members Financial institution is making use of the HEMS standard, which means "Health, Education And Learning, Upkeep, or Assistance." This guideline is usually consisted of in trust fund agreements to route the trustee on just how they can distribute funds to beneficiaries. By adhering to the HEMS standard, the trust makes certain that circulations are made for essential requirements and lasting support, guarding the trust fund's possessions while still attending to member of the family.

Boosted Versatility: Unlike stiff bank lendings, you regulate the payment terms when obtaining from your very own plan. This allows you to structure settlements in a way that lines up with your organization capital. infinite the chaser live music bank. Better Cash Flow: By financing organization expenditures via policy finances, you can potentially liberate cash that would certainly otherwise be locked up in traditional finance settlements or tools leases

He has the very same tools, but has actually additionally developed extra cash money value in his plan and obtained tax advantages. And also, he now has $50,000 offered in his policy to utilize for future possibilities or expenditures., it's important to view it as more than simply life insurance coverage.

Create Your Own Bank

It has to do with developing a flexible funding system that provides you control and gives multiple benefits. When made use of tactically, it can match various other financial investments and company techniques. If you're captivated by the potential of the Infinite Financial Concept for your organization, below are some steps to consider: Inform Yourself: Dive much deeper into the principle via reputable publications, workshops, or consultations with educated professionals.

Table of Contents

Latest Posts

Infinite Banking Insurance

Infinite Financial Systems

Infinite Income Plan

More

Latest Posts

Infinite Banking Insurance

Infinite Financial Systems

Infinite Income Plan